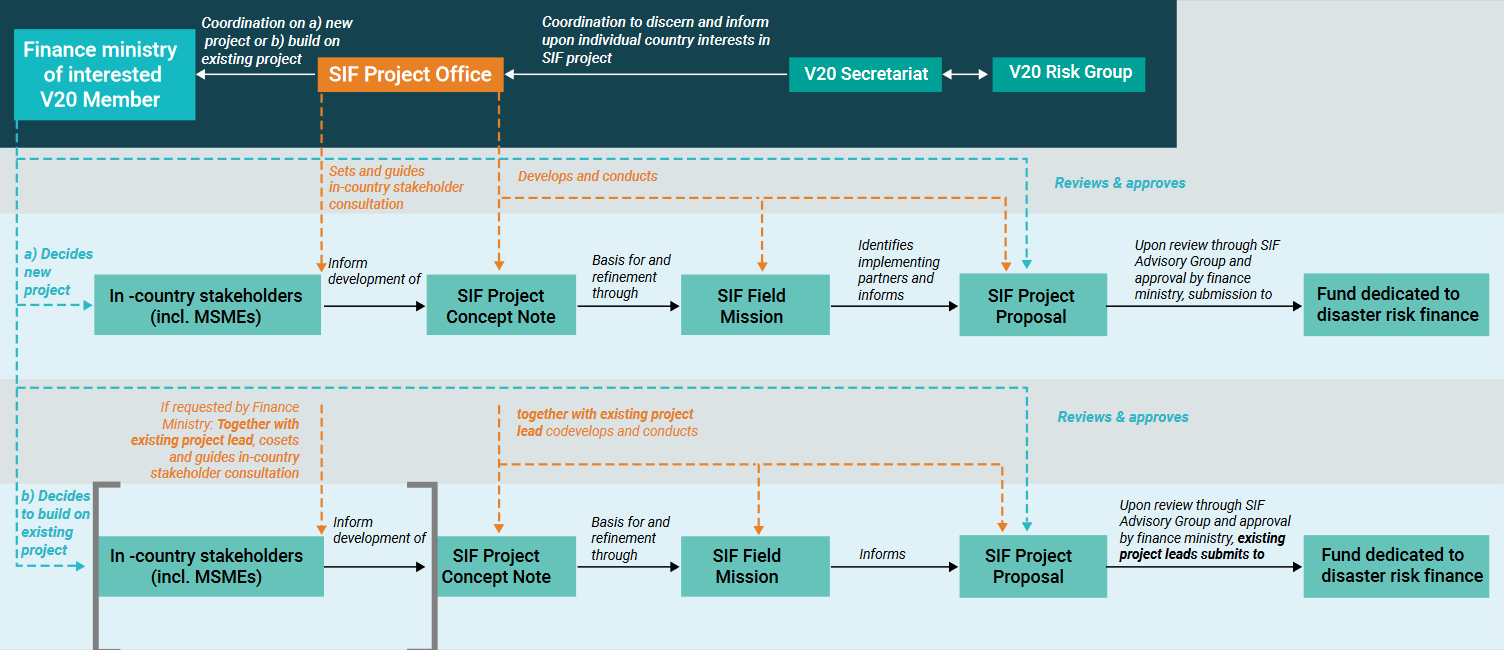

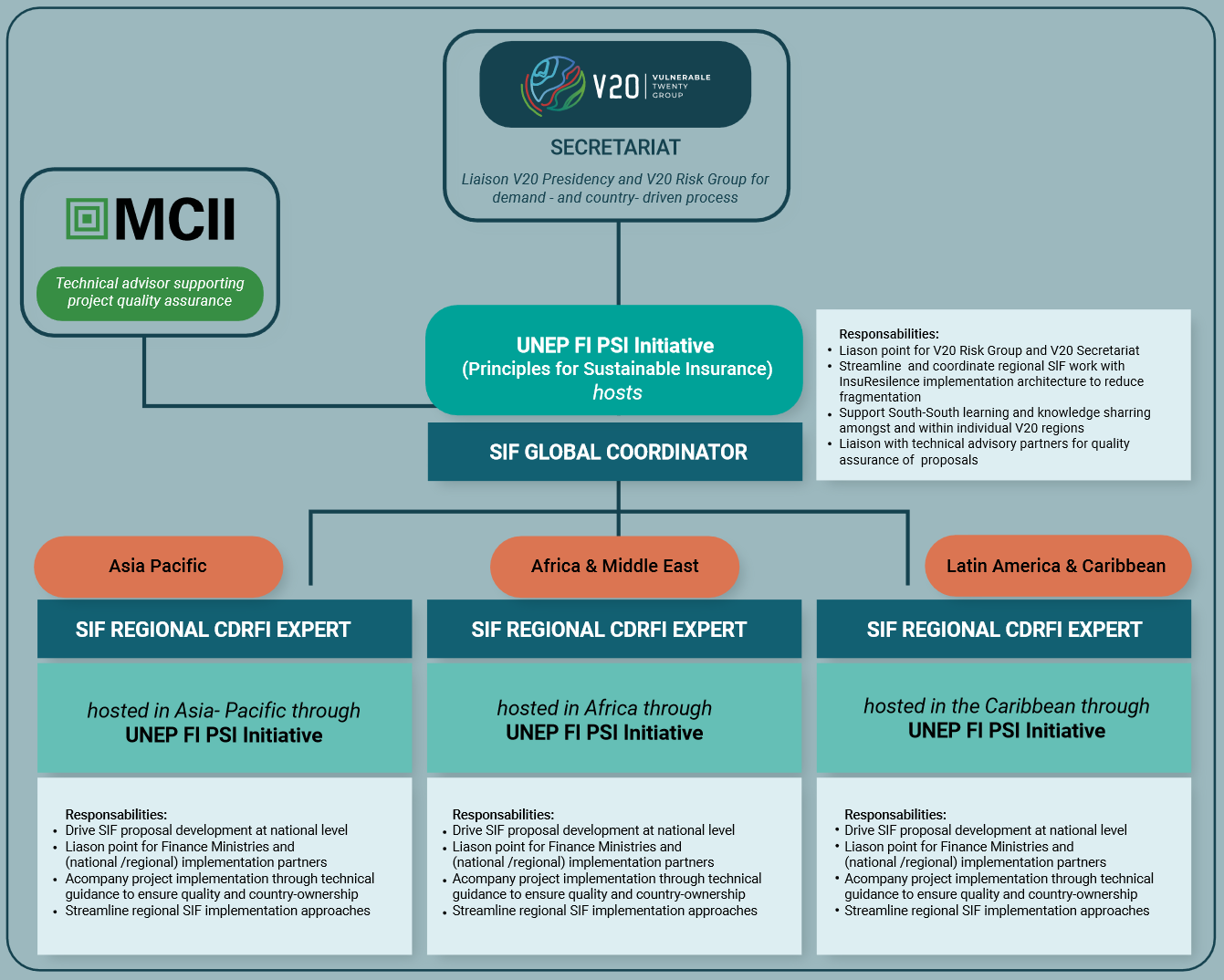

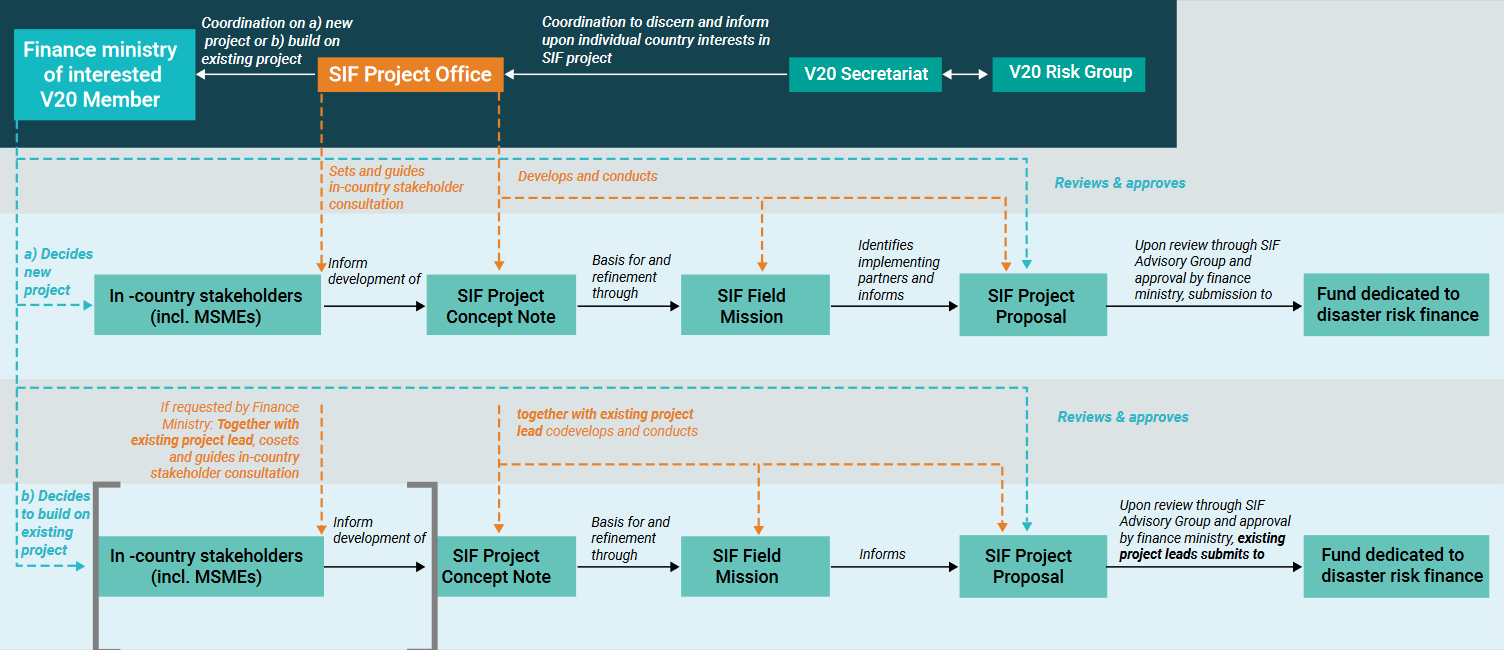

The Process of SIF Project Pipeline Development and Engagement Opportunities

The identification of SIF project countries is based on the expression of interest through V20 member countries. Project pipeline development is intended to commence via two tracks:

Track 1: Internal, initiated by the SIF Project Office:

The SIF Project Office will coordinate closely with the V20 Secretariat and the Co-Chairs of the V20 Risk Group to gauge and identify national interest in SIF projects. Upon such interest expressed, the SIF Project Office will coordinate with the respective Finance Ministries to understand whether the ministry wishes to mandate the Project Office to either prepare a new, independent project proposal, or wishes for the Project Office to engage with and build on an already on-going project. As for the former, the Project Office will set up in-country consultations with relevant stakeholders and ministries to scope MSME insurance needs and extract key priority areas. Based on these consultations, a project concept note will be developed. To refine the details of the concept note and translate it into a full project proposal, the SIF Project Office will conduct a field mission, as part of which it may also identify implementing partners who may be interested in carrying out planned project activities.

Subsequently, the concept note will be developed into a fully-fledged proposal and shared with the respective Finance Ministry as well as with the SIF Advisory Group to facilitate final feedback and buy-in. Finally, the project proposal will be submitted to one of the funding vehicles (or other funding structures, if more appropriate). Depending on the funding guidelines of the respective disaster risk financing vehicles, the proposal may be tendered on behalf of the V20 or directly submitted through a previously identified implementing organization/s, endorsed and supported by the V20.

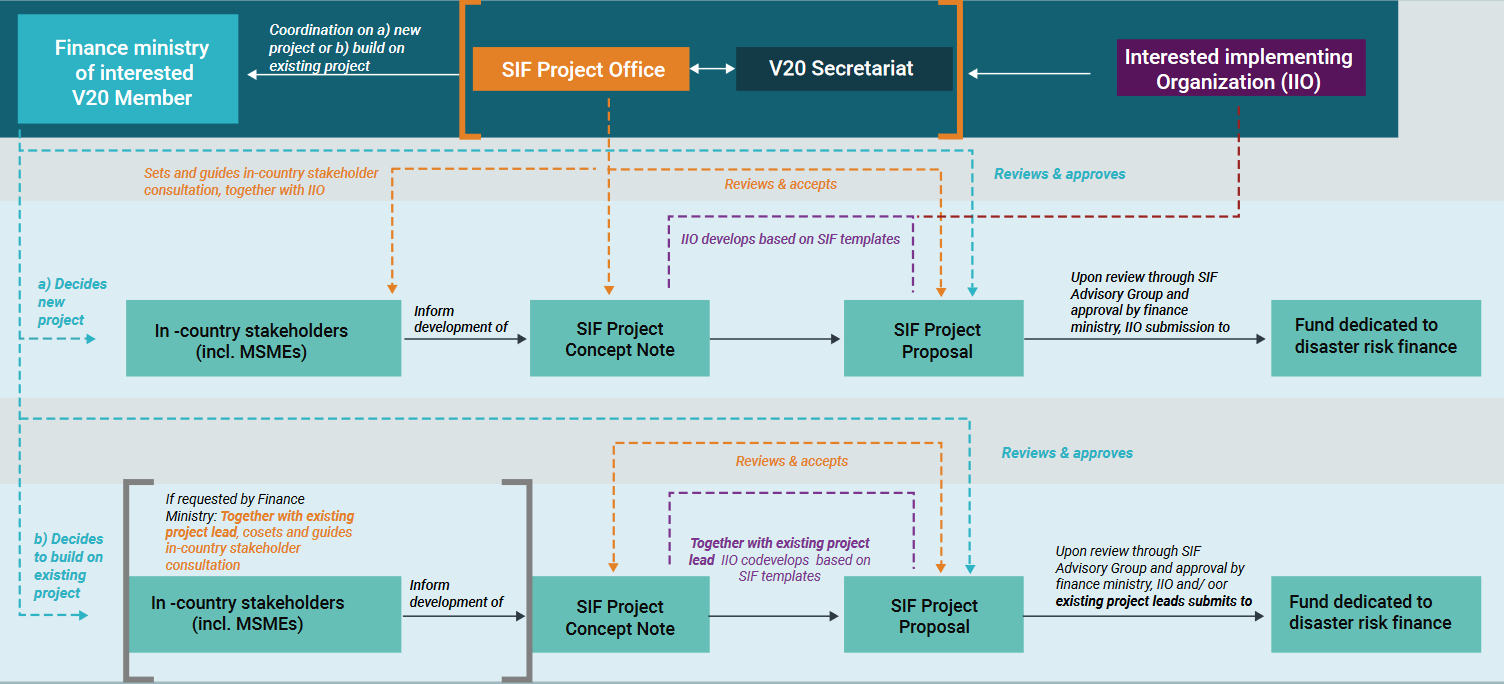

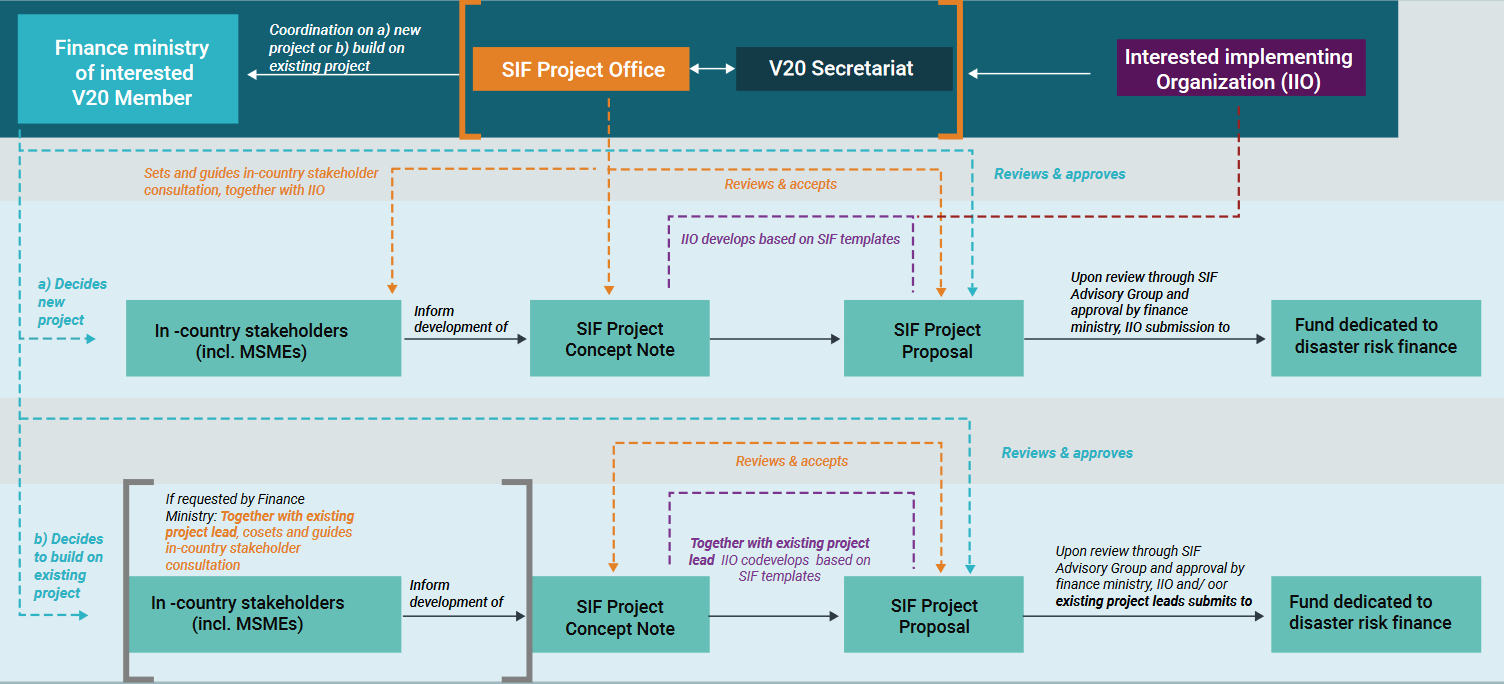

Track 2: External, initiated by interested implementing organizations:

Implementing organizations interested in or already working in V20 economies may also approach the V20 Secretariat and/or SIF Project Office with project ideas and concepts. The Project Office will then coordinate with the V20 Secretariat and the respective national Finance Ministries, including on whether the latter wishes to mandate the Project Office to coordinate the preparation of a new project proposal, or for the Project Office to engage with and build on an already on-going project. Upon expression of interest through the national Finance Ministry, the Project Office will initiate a process similar to the above, together with the interested implementing organization, if feasible. This entails in-country stakeholder consultations including the finance ministry to scope relevant insurance needs and extract key priority areas. Upon conclusion of these consultations, the interested implementing organization (IIO) will receive a SIF Concept Note and Proposal Template to elaborate planned activities, explain how they align with the SIF Action Areas and outline implementation arrangements. Upon approval by the SIF Project Office, the IIO will submit the project proposal to one of the funding vehicles (or other funding structures, if deemed more appropriate by the SIF Project Office), alongside official V20 endorsement and support.

Engagement opportunities with the SIF outside of Project Pipeline Development

In addition to welcoming the development of joint implementation proposals with IIOs, organizations can also support the V20 demand by driving research and evidence aligned with the SIF Action areas. Indicative topics include regulatory challenges regarding MSME access to financial services, MSME implementation of integrated risk management approaches, and analysis and assessment of promising avenues to anchor MSME insurance in policy objectives of V20 economies, including capital market development, resilience building for households and enterprises, industry growth plans, and other relevant frameworks. Further, IIOs are also welcome to align ongoing and planned project activities more strongly with the SIF Action areas and share their knowledge and experiences with the V20 Secretariat and in support of South-South learning initiatives of the V20.